The Definitive Guide to Summitpath Llp

The Definitive Guide to Summitpath Llp

Blog Article

Summitpath Llp Can Be Fun For Anyone

Table of ContentsThe 8-Minute Rule for Summitpath LlpThe smart Trick of Summitpath Llp That Nobody is Talking AboutThe Only Guide for Summitpath LlpThe Basic Principles Of Summitpath Llp The 10-Second Trick For Summitpath Llp

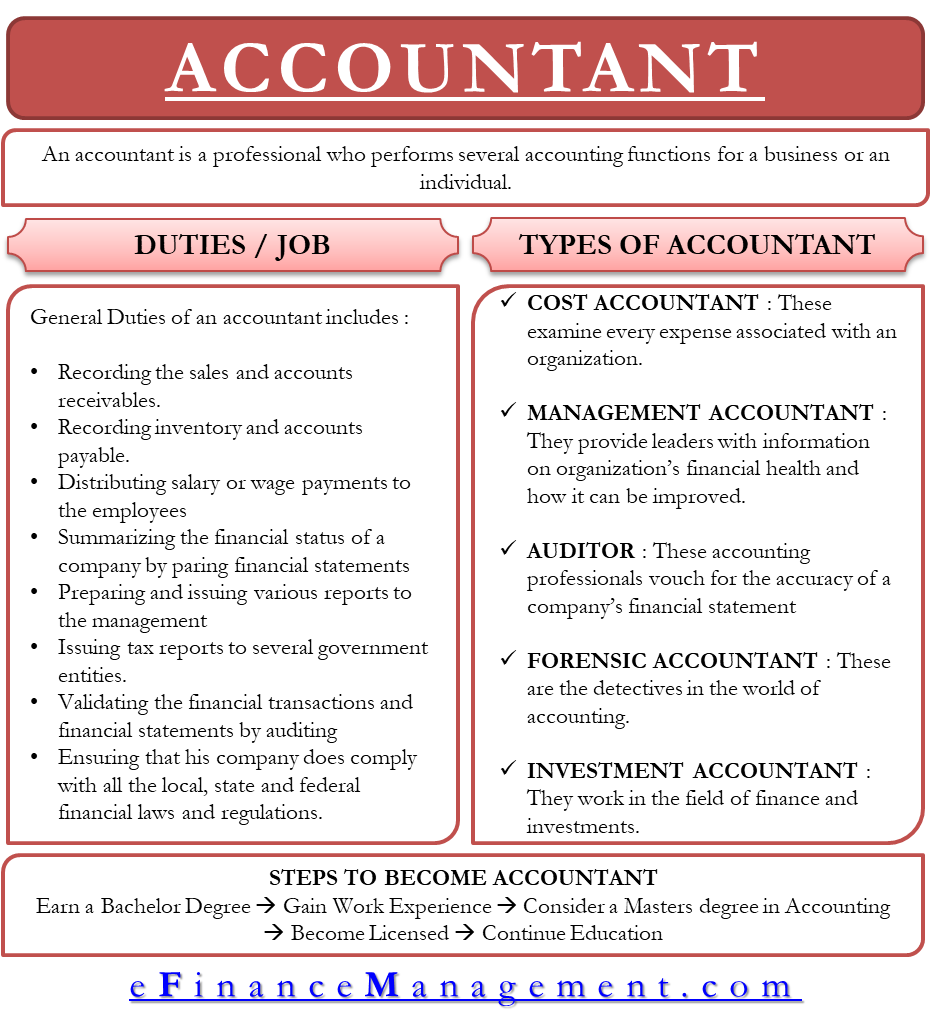

A monitoring accountant is a key role within a business, however what is the duty and what are they expected to do in it? ICAEW digs much deeper in this monitoring accountant overview. https://www.startus.cc/company/summitpath-llp. An administration accounting professional is an essential duty in any type of organisation. Functioning in the accountancy or money department, administration accounting professionals are accountable for the prep work of management accounts and a number of various other reports whilst additionally supervising general accounting treatments and methods within the business.Putting together approaches that will decrease business costs. Acquiring money for tasks. Suggesting on the monetary effects of company choices. Developing and supervising economic systems and procedures and determining chances to enhance these. Controlling earnings and expenditure within the service and making certain that expenditure is inline with budget plans. Looking after accountancy specialists and assistance with generic accountancy jobs.

Analysing and managing threat within business. Monitoring accountants play a highly crucial duty within an organisation. Secret monetary data and records generated by monitoring accountants are made use of by elderly management to make educated company choices. The analysis of company efficiency is an important function in an administration accountant's work, this evaluation is created by considering current financial info and additionally non - economic information to figure out the setting of the business.

Any type of service organisation with a monetary department will call for a monitoring accounting professional, they are likewise frequently employed by monetary institutions. With experience, a management accounting professional can anticipate solid career development.

Summitpath Llp - Questions

Can see, evaluate and encourage on alternate resources of business financing and different methods of elevating financing. Communicates and suggests what impact economic decision making is carrying growths in guideline, ethics and governance. Assesses and suggests on the right methods to take care of company and organisational efficiency in regard to business and financing threat while interacting the impact successfully.

Makes use of various innovative methods to implement technique and manage modification - Calgary Accountant. The distinction between both financial accountancy and managerial bookkeeping concerns the designated individuals of information. Supervisory accounting professionals need company acumen and their aim is to work as organization partners, aiding service leaders to make better-informed choices, while economic accountants intend to create economic records to supply to external celebrations

Rumored Buzz on Summitpath Llp

An understanding of service is likewise crucial for administration accountants, along with the ability to communicate properly in all degrees to encourage and liaise with senior participants of personnel. The responsibilities of an administration accountant need to be executed with a high degree of organisational and tactical reasoning abilities. The average wage for a legal management accounting professional in the UK is 51,229, a boost from a 40,000 average gained by administration accountants without a chartership.

Giving mentorship and management to junior accountants, cultivating a culture of cooperation, growth, and functional excellence. Collaborating with cross-functional groups to develop spending plans, forecasts, and lasting monetary strategies. Remaining informed regarding changes in audit policies and ideal practices, using updates to internal procedures and documents. Must-have: Bachelor's level in accounting, money, or a related field (master's favored). CPA or CMA qualification.

Generous paid time off (PTO) and company-observed holidays. Expert growth possibilities, including repayment for CPA accreditation expenses. Flexible job options, including crossbreed and remote timetables. Accessibility to health cares and employee assistance resources. To apply, please submit your resume and a cover letter outlining your credentials and passion in the elderly accounting professional role. tax preparation services.

Not known Details About Summitpath Llp

We aspire to discover a competent elderly accountant all set to contribute to our firm's financial success. For queries concerning this setting or the application procedure, contact [HR call information] This task uploading will end on [day] Craft each area of your job summary to reflect your company's one-of-a-kind needs, whether working with a senior accounting professional, company accountant, or another expert.

A strong accounting professional task account goes past listing dutiesit clearly interacts the certifications and expectations that align with your organization's requirements. Separate in between crucial qualifications and nice-to-have abilities to aid candidates gauge their viability for the position. Specify any accreditations that are mandatory, such as a CPA (State-licensed Accountant) license or CMA (Qualified Monitoring Accounting professional) classification.

The Summitpath Llp Statements

Follow these finest practices to develop a task summary that resonates with the right prospects and highlights the unique facets of the role. Audit functions can differ commonly relying on ranking and specialization. Prevent ambiguity by detailing certain tasks and areas of focus. "prepare regular monthly monetary statements and look after tax obligation filings" is much clearer than "take care of economic documents."Reference key areas, such as monetary reporting, bookkeeping, try here or payroll administration, to bring in prospects whose skills match your needs.

Accountants aid companies make crucial monetary choices and adjustments. Accounting professionals can be responsible for tax coverage and filing, fixing up balance sheets, assisting with department and organizational budgets, financial projecting, interacting findings with stakeholders, and much more.

Report this page